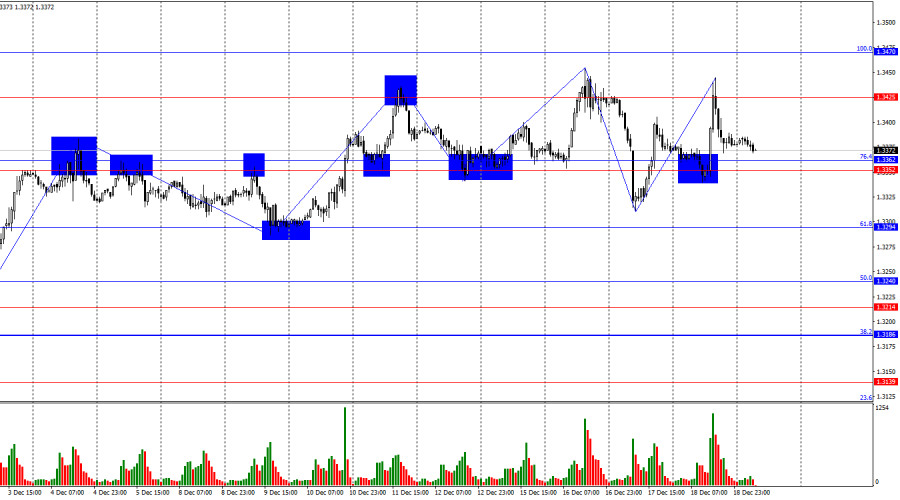

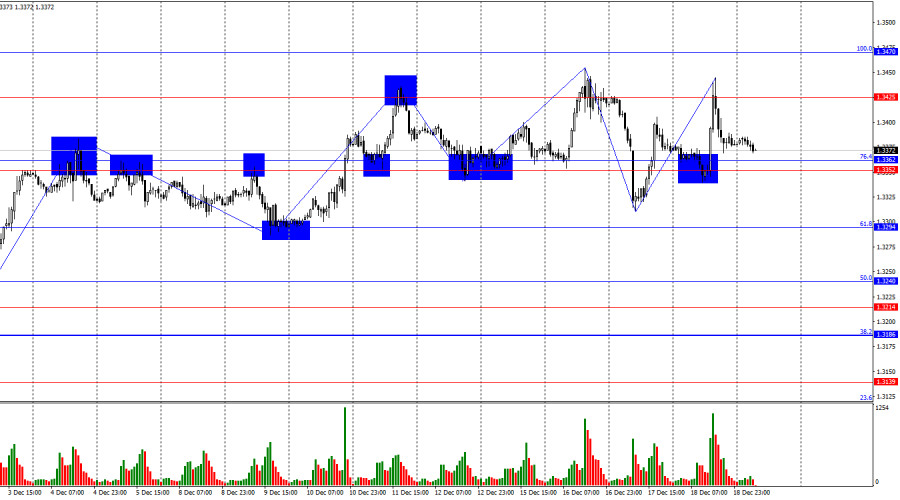

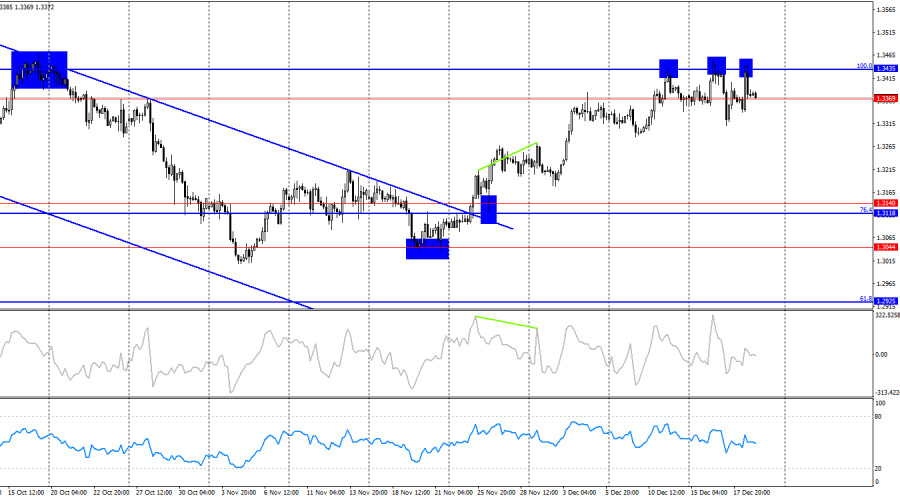

On the hourly chart, the GBP/USD pair on Thursday bounced off the support level of 1.3352–1.3362, rose to the 1.3425 level, rebounded from it, and began a new decline toward 1.3352–1.3362. Another rebound of quotes from this zone would again work in favor of the pound and lead to some growth toward the 1.3425 and 1.3470 levels. A firm break below the zone would allow traders to expect a continuation of the decline toward the 1.3294 and 1.3240 levels.

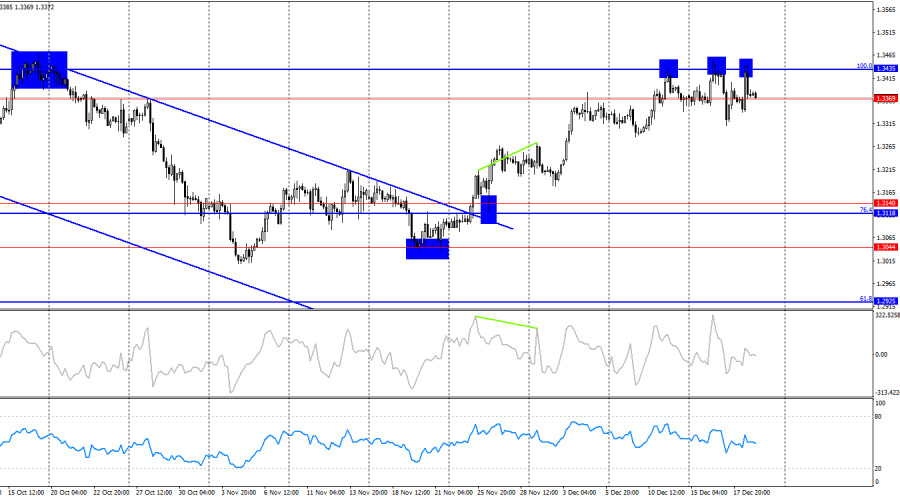

The wave picture turned "bullish" several weeks ago, but this week it shifted back to "bearish." The last completed upward wave broke the previous peak by only a few points, while the most recent downward wave managed to break the previous low. The news background for the pound has been weak in recent weeks, and the bears have fully worked it off. At the same time, the U.S. news background also leaves much to be desired. This week, however, not the most positive data have again started coming out of the UK. That said, the U.S. did not please the dollar with strong statistics either.

Thursday's news background sparked a lot of debate and discussion in the market. The Bank of England made the expected decision to cut interest rates, which came as no surprise. At the same time, it remains unclear how the British central bank intends to act next year. Meanwhile, in the U.S., the November inflation report was released, showing a slowdown in price growth to 2.7% year-on-year. Such a figure could have convinced the market of the need for further monetary easing by the FOMC in January, but many economists immediately pointed out that no long-term conclusions should be drawn from the November inflation reading alone. In November, "Black Friday" took place worldwide—a discount day that has long ceased to be just one day. Discounts, sales, and promotions begin a week or even two before Black Friday. As a result, prices were artificially suppressed for at least half a month. The next inflation report for December may already show a renewed increase in the consumer price index. Thus, neither the bulls nor the bears were able to benefit from yesterday's events, although at first glance both seemed to allow no double interpretation.

On the 4-hour chart, the pair completed a third rebound from the 100.0% corrective level at 1.3435, reversed in favor of the U.S. dollar, and began a new decline toward the 1.3140 level. A firm consolidation above 1.3435 would allow expectations of further growth toward the Fibonacci level of 127.2% at 1.3795. No emerging divergences are observed today on any indicator.

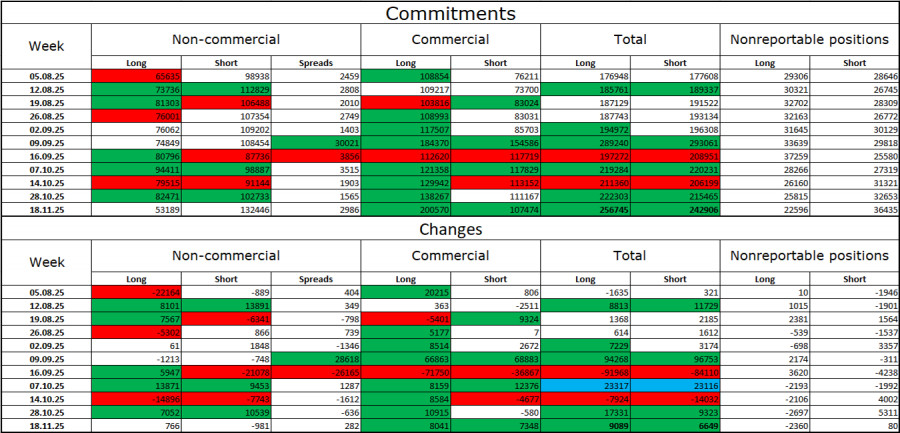

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders did not change over the last reporting week, although this reporting period was a month ago—dated November 18. The number of long positions held by speculators increased by 766, while the number of short positions decreased by 981. The gap between the number of long and short positions is now effectively as follows: 53 thousand versus 132 thousand. As we can see, bears dominated a month ago, but the situation may now be completely different. And for the euro, it was the opposite even a month ago. Thus, I do not believe that the market for the pound is currently "bearish."

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency occasionally enjoys demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to ease monetary policy in order to curb rising unemployment and stimulate job creation. For 2026, the FOMC does not plan aggressive monetary easing, but at the moment no one can be sure of this, because labor market statistics are still lacking.

Economic Calendar for the U.S. and the UK:

- United Kingdom – Change in retail sales volume (07:00 UTC).

- United States – Existing home sales (15:00 UTC).

- United States – University of Michigan Consumer Sentiment Index (15:00 UTC).

On December 19, the economic calendar contains only three events, each of which is less important than the data released earlier this week. The impact of the news background on market sentiment on Friday may be weak.

GBP/USD Forecast and Trading Advice:

Selling positions could be opened on a rebound from the 1.3425 level on the hourly chart with a target of 1.3352–1.3362. The target has been reached. New sell positions can be considered after a close below the 1.3352–1.3362 level with a target of 1.3294. Today, I recommend considering buy positions on a rebound from the 1.3352–1.3362 level with targets at 1.3425 and 1.3470.

Fibonacci level grids are built from 1.3470 to 1.3010 on the hourly chart and from 1.3431 to 1.2104 on the 4-hour chart.