Trade analysis and recommendations for the British pound

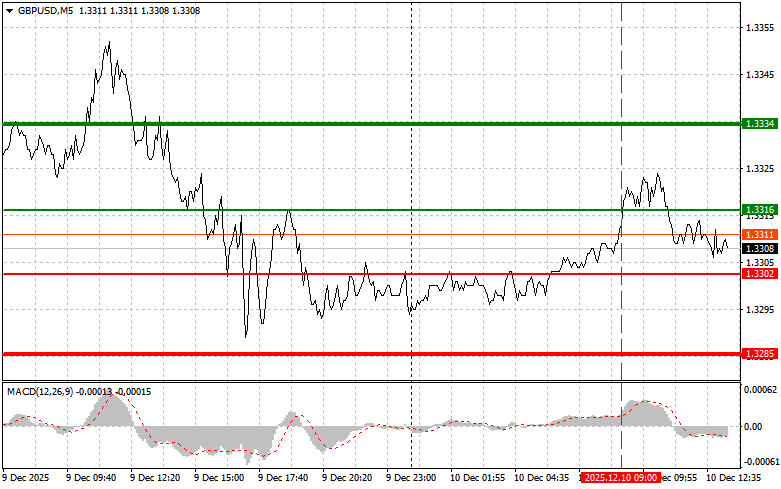

The price test of 1.3316 occurred when the MACD indicator had already moved far above the zero mark, which limited the pound's upward potential. For this reason, I did not buy.

The absence of important fundamental statistics from the UK provided only slight support to buyers of the British pound. Amid the overall uncertainty related to the Federal Reserve's next steps, a short break from negative news allowed investors to focus on technical factors and recover part of the previously lost positions. However, it is worth noting that this growth is most likely corrective in nature and does not indicate a continuation of the upward trend in the pair.

In the second half of the day, the FOMC decision on the main interest rate is expected, which will almost certainly be lowered, followed by Jerome Powell's press conference. Markets have already priced in a rate cut, so the key point will be Powell's rhetoric and hints about future policy. Investors will closely monitor any signals regarding the Fed's next steps, trying to determine whether this rate cut will be the last or whether it marks a continuation of the dovish monetary policy cycle that will extend into next year. Special attention will be paid to Powell's assessment of the current labor market conditions and inflation outlook. If he expresses concern or indicates that inflation remains above the target level, this may push markets toward expecting a more restrictive policy, which would support the U.S. dollar. Overall, today's FOMC meeting and Powell's press conference promise to be eventful and could bring significant volatility to financial markets.

As for intraday strategy, I will mainly rely on scenarios No. 1 and No. 2.

Buy Signal

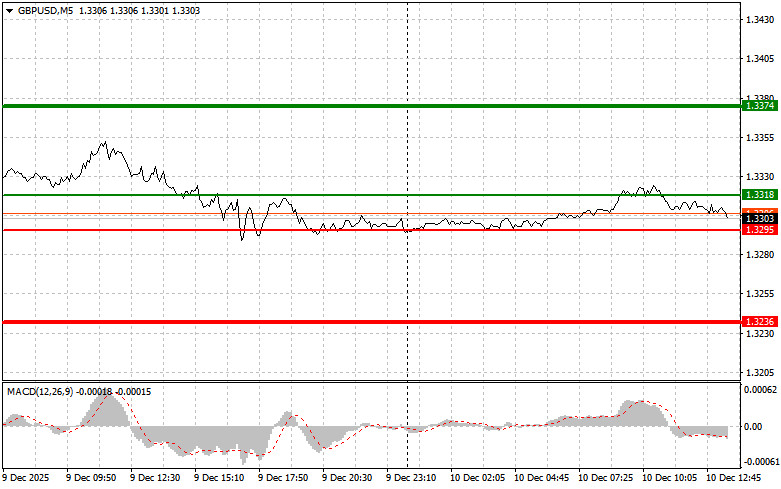

Scenario No. 1: I plan to buy the pound today once the price reaches the entry point around 1.3318 (green line on the chart), targeting a rise toward 1.3374 (the thicker green line). Around 1.3374, I will exit buy positions and open sell trades in the opposite direction (expecting a movement of 30–35 points in the opposite direction). A rise in the pound today can be expected only if the Fed adopts a dovish stance. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning its upward movement.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3295 price level at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. A rise can be expected toward the opposite levels of 1.3318 and 1.3374.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price breaks below the 1.3295 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 1.3236 level, where I will exit sell positions and also open buy trades in the opposite direction (expecting a 20–25 point move upward from the level). Pressure on the pound may return today if the Fed takes a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3318 price level at a time when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline can be expected toward the opposite levels of 1.3295 and 1.3236.

What's on the chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – assumed price for placing Take Profit or manually securing profit; above this level, further growth is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – assumed price for placing Take Profit or manually securing profit; below this level, further decline is unlikely.

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important

Beginner Forex traders should make entry decisions with great caution. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you ignore money management principles and trade large volumes.

And remember: for successful trading, you must have a clear trading plan—like the one I presented above. Spontaneous trading decisions based on the current market situation are, by default, a losing strategy for an intraday trader.